Ok, just the facts…Some of you may know them, some of you may understand some of them, and I bet there are some of you who will be surprised by what I have to say. Judging by the number of people who actually came to the many Town Hall meetings that all five Supervisors offered in September on the “State of the County”…I now think that there will be quite a few people reading this blog post who will raise their eyebrows.

The first thing I want to say is that “all counties are not created equal”. Some have a majority of taxable land available to them, from which to gather a healthy property tax base. Tuolumne County has about 23% taxable land from which we receive $35.1 million. A whopping 77% is federal or State-owned property which pays our county a measly $3.1 million for the loss of taxable land. Huh!?

Next, out of every dollar you pay for property taxes in this county, the County of Tuolumne receives only 26 cents. Shocker! For example, let’s say you pay $3000 a year in property taxes. The County does not get that $3000. No where near! We get 26% of that, or $780. Even the schools receive more of your property tax…64 cents from every dollar you pay. By the way, many people think the County Board of Supervisors oversee the schools. I am here to tell you that we do not. They have their own budget and of that $3000 you pay in property tax, they receive $1,920! Every county is different in this regard as well, as to how they divide up the property tax pie. How that happened, so long ago is for another discussion.

The funding that is supposed to cover maintaining our roads? Some of it comes from SB1 funding. You may have heard it mentioned as gas tax money. In this county we collect about $3.5 million each year from SB1. Other funding comes from a combination of grants, Local Transportation Funds, the Secure Rural Schools Self Determination Act (when authorized by the feds), and about $775,000 from the General Fund. $11.9 M in all to pave and somehow maintain all 610 miles of county roads. But with the cost of paving or repaving one mile of a two-lane road (depending on the condition of that road) between $250,000 to $1M, I ask you, how we are ever, ever going to catch up? Or be able to properly maintain your neighborhood road? This problem is the result of decades of the State underfunding or flat out not paying the County for maintaining the roads. However, somehow, our Board has been able to add $5M+ funding from other sources in the past several years to pave one major collector in all 5 Supervisorial Districts – which actually moved up our pavement condition index (PCI) up a couple of notches after decades of spiraling downward numbers.

Let’s turn our attention to sales tax now. Tuolumne County’s sales tax rate is the lowest it can be in this State: 7.25%. When you spend $100 on taxable merchandise, you also pay $7.25 in addition to the $100. Where does that money go? Right off the bat, $6 of it goes into the State’s coffers. $1 of it comes to the County, and $0.25 goes to our Regional Transportation Council. If a sales tax initiative were to pass, and our tax rate becomes 8.25%, we would get $2 instead of $1 for every $100 spent. Right now, our sales tax revenue brings in about $6.5M. We could double that figure and better help pay for essential services in the next few years and have funding to invest in economic development projects that would actually grow our economy.

What about that Transient Occupancy Tax (TOT)? This is the tax that mostly visitors pay when they stay in lodging and many campsites here. I will tell you right now, that it primarily goes into the General Fund to plug the holes and make up some of the difference in what the above-mentioned taxes do NOT even come close to paying.

Plainly put: Our revenue situation is a vicious cycle akin to being on a hamster wheel…a cycle we have been on for decades now.

If you attended our “State of the County” Town Halls given in September, you learned all this and more. If you weren’t able to, please visit https://accesstuolumne.org and watch the full Groveland Town Hall, presented on Sept 12th, and available “on demand” at Access Tuolumne – our local public TV station. Here is the link to my first Town Hall on September 12, 2024: https://media.accesstuolumne.org/CablecastPublicSite/show/6340?site=1

Ok, so the upshot?: Out of a total final budget in fiscal year 2024-25 of $302.7M (this is the updated number from our Board of Supervisors final budget approval on 10/1/2024), only $70.7M is discretionary or General Fund revenue! What does this mean? It means that $232M of the revenue for our County is “spoken for” and can only be used for specific programs and services. An example of this would be funding that comes in for Public Health cannot be spent on roads or our Sheriff’s Department.

Some of our County General Fund departments are, for example: The Sheriff/Coroner/Jail, our District Attorney/Victim Witness and Public Defender, Probation, Community Development, Animal Control, Assessor-Recorder, Auditor-Controller and so many more…over 39 departments in all! And what this Board of Supervisors has been struggling with, as past Boards have, is how roughly $71M is going to cover all the essential services that our community expects?

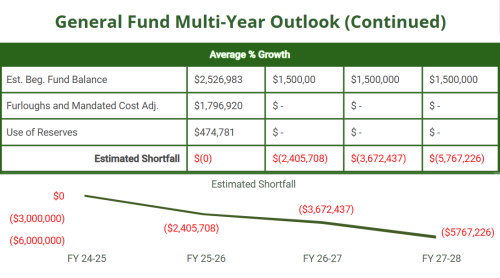

What is our General Fund outlook for the next 3 years? Here is a chart from our multi-year outlook. Next fiscal year, we will have a shortfall of $2.4M, and in FY 2026-27 it will grow to almost $3.7M, and in the third FY, it will balloon to almost $5.8M.

There are many reasons for this, ranging from unfunded mandates from the State (where they demand we continue to provide services even though the State has discontinued or reduced paying for it), to unforeseen natural disasters (flooding events most recently), to rising insurance costs, unfunded liabilities, to runaway inflation where everything costs more including salaries for competent staff. Again, I refer you to the video of my State of the County Town Hall to get more of the specifics here.

These are the facts. I think that everyone should be armed with this fiscal education so they can be better prepared for the November election. I am not here to persuade you one way or another, but I do believe the facts speak for themselves.

Thank you for bearing with me in reading this blog post. It was not a fun one to write! As with everything else, if you have questions, please email me at: khaff@co.tuolumne.ca.us

Thank you.